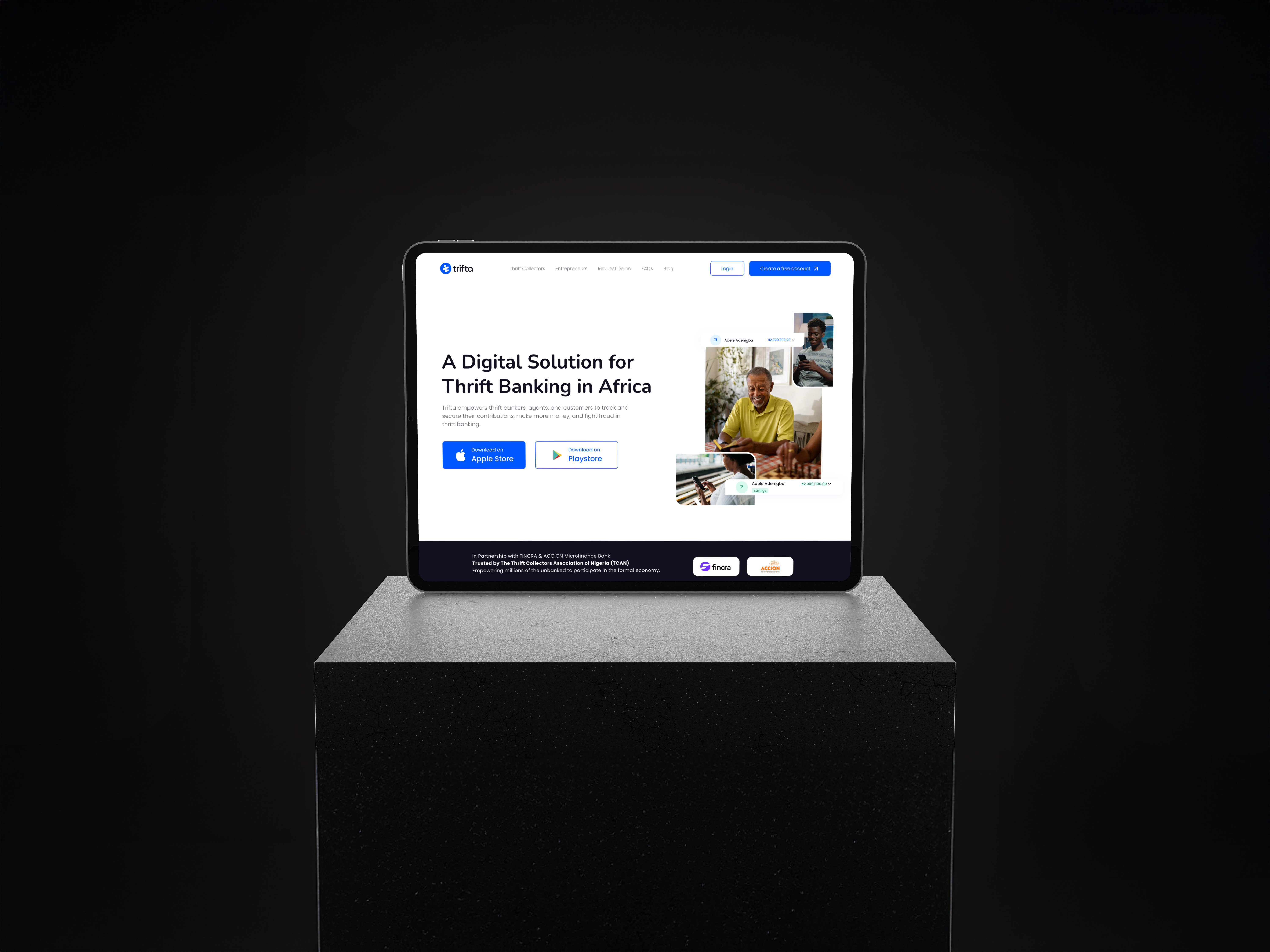

Website Redesign: The new design was focused on improving navigation and enhancing the user journey. By simplifying the homepage and prioritizing key actions, merchants were able to access vital services like savings management, loans, and customer interactions more easily. The design was also optimized for low-data usage, ensuring users with slower internet connections could still interact with the platform effectively.

POS Application Design: This design focused on quick access to core features like transaction tracking and loan management, allowing merchants to operate efficiently in busy market environments. The interface was designed to be easy to use in low-light and fast-paced conditions, supporting merchants with clear icons and minimal steps to complete tasks.

Web Applications: The admin and user interfaces were streamlined to provide a more intuitive experience. Admins could now manage user accounts, savings, and loans with ease, while users gained clearer access to their account details, contributions, and loan statuses.

Mobile App Enhancements: The redesign of the mobile app introduced an improved user interface that was visually cohesive with the web platform. Accessibility features were added, such as larger text and simplified navigation, ensuring that even users with limited digital literacy could interact with the platform comfortably.