On the Go Finances with Shield wallet

Year: 2023 Role: Product Design, Competitive Analysis, User Research, Interaction Design, Product Strategy Industry: Fintech, Banking

Shield, a financial service provider, aimed to create a digital wallet proposition that appeals to a diverse clientele, including Odogwu's, Gen-A & Z, artisans, and market women. The Goal was to:

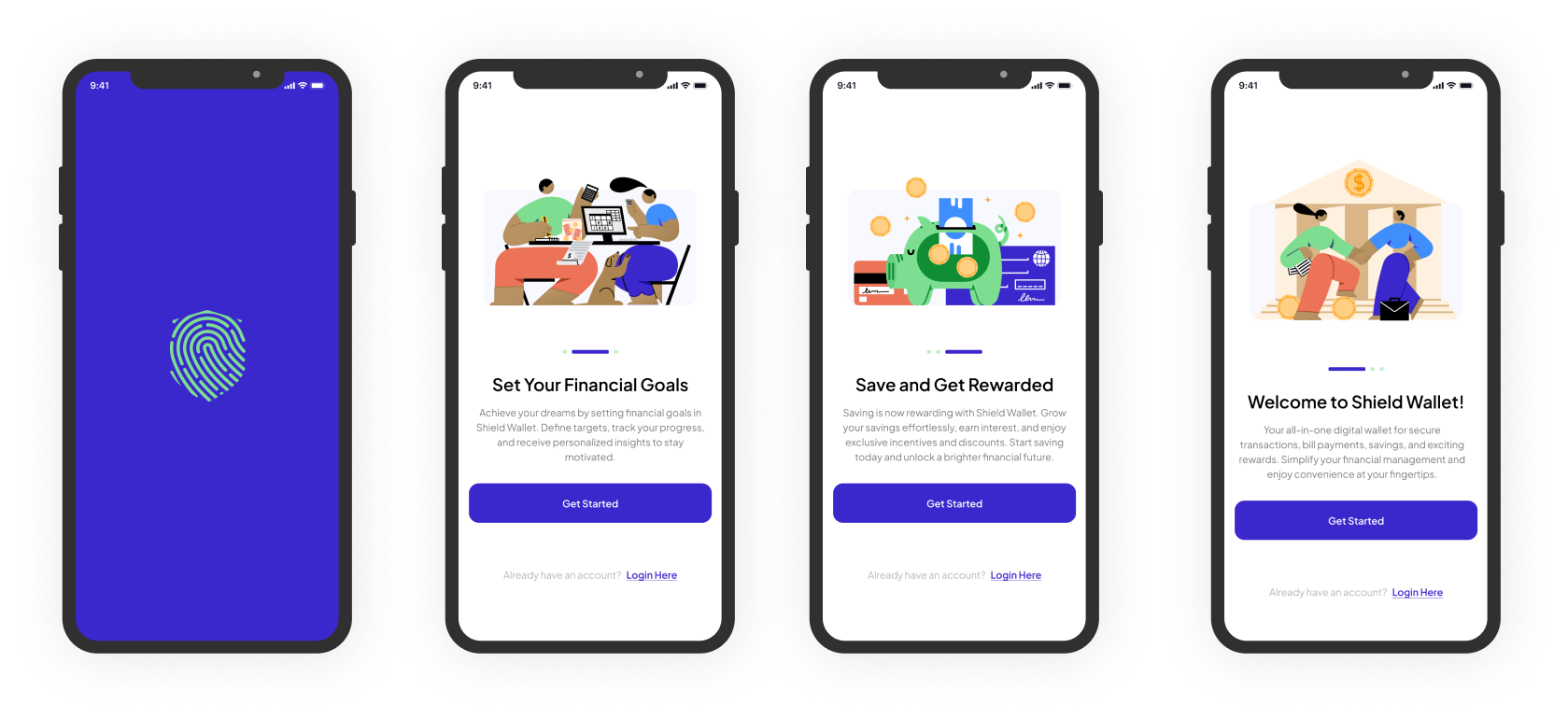

Design and develop a Minimal Viable Product (MVP) for Shield's digital wallet proposition.

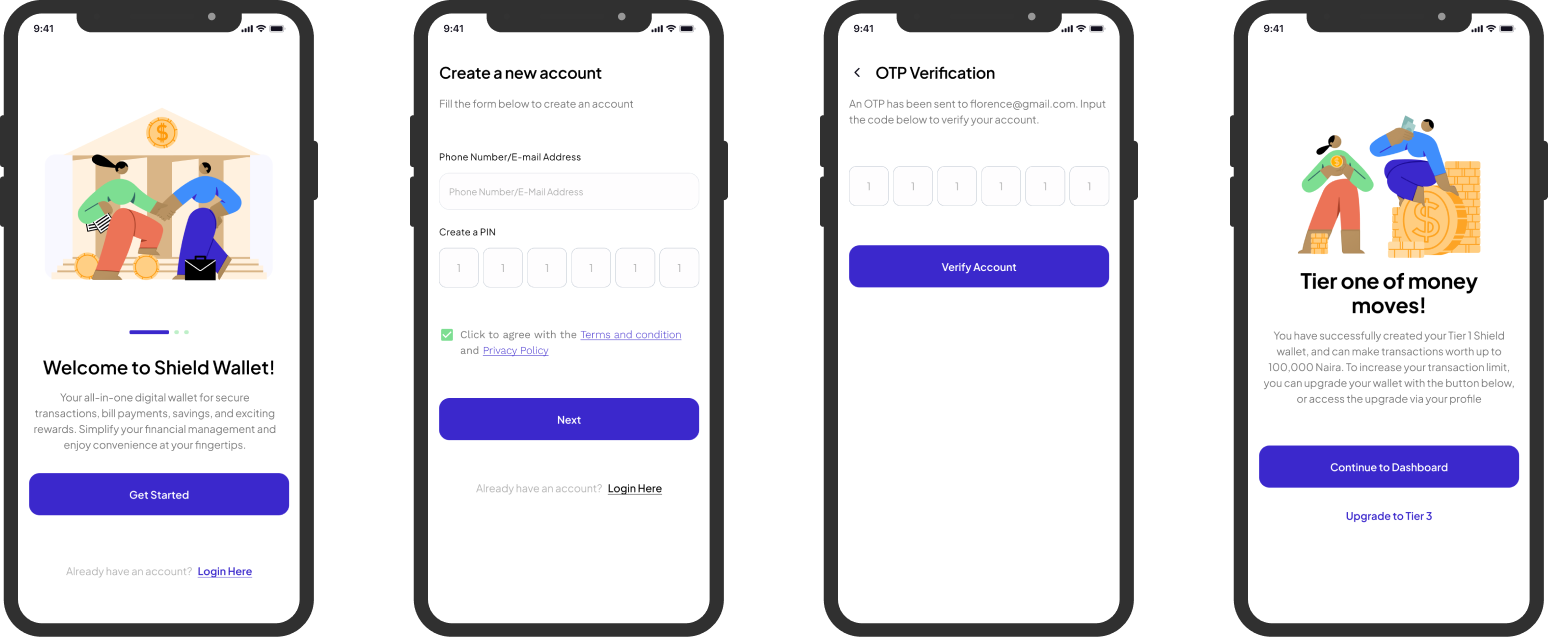

Simplify the onboarding process to make it easy and intuitive for users to sign up and access the wallet's features.

Enable seamless wallet tier upgrades, allowing users to unlock additional functionalities and benefits as they progress.

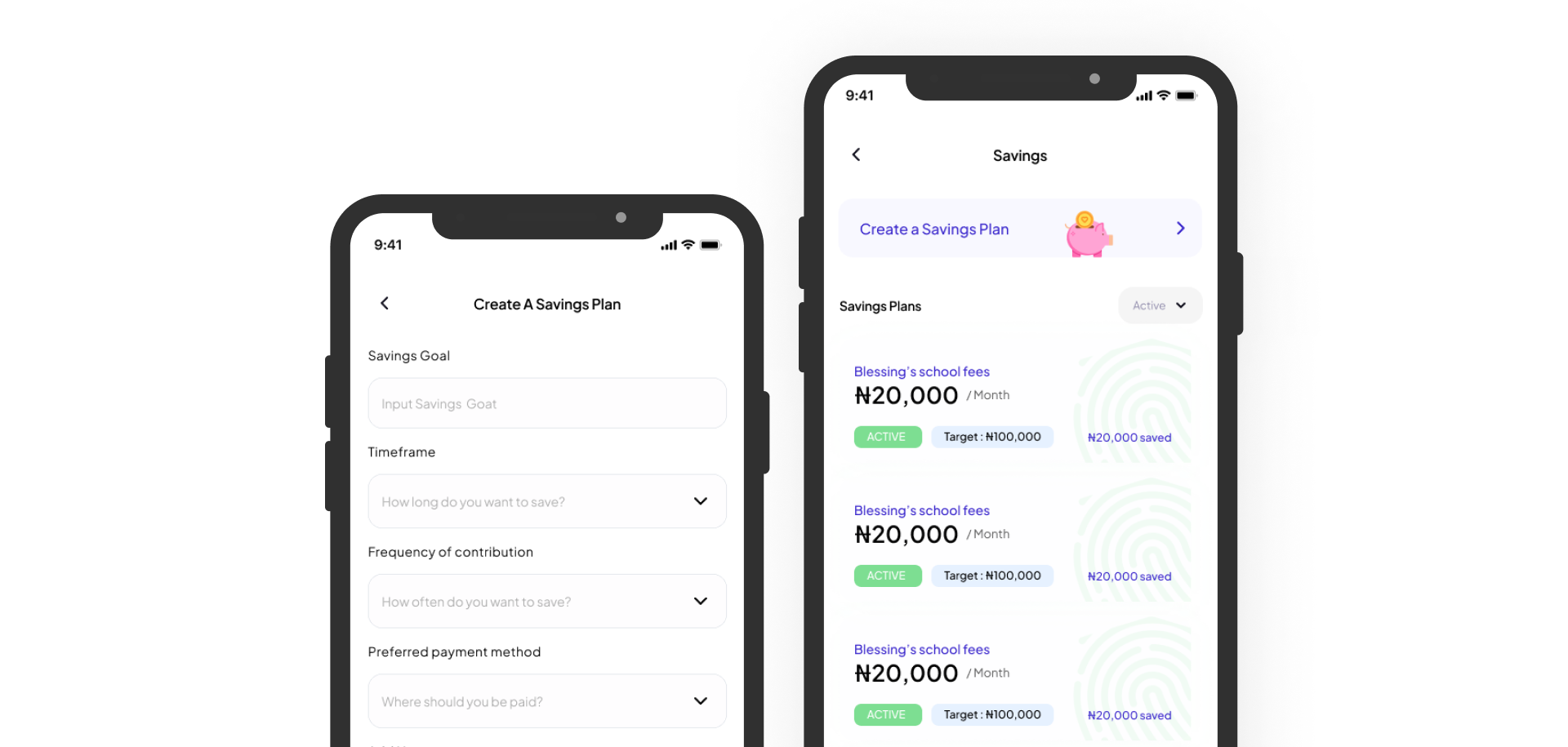

Promote savings by providing users with the ability to set targets, save easily, and receive rewards for their saving efforts.

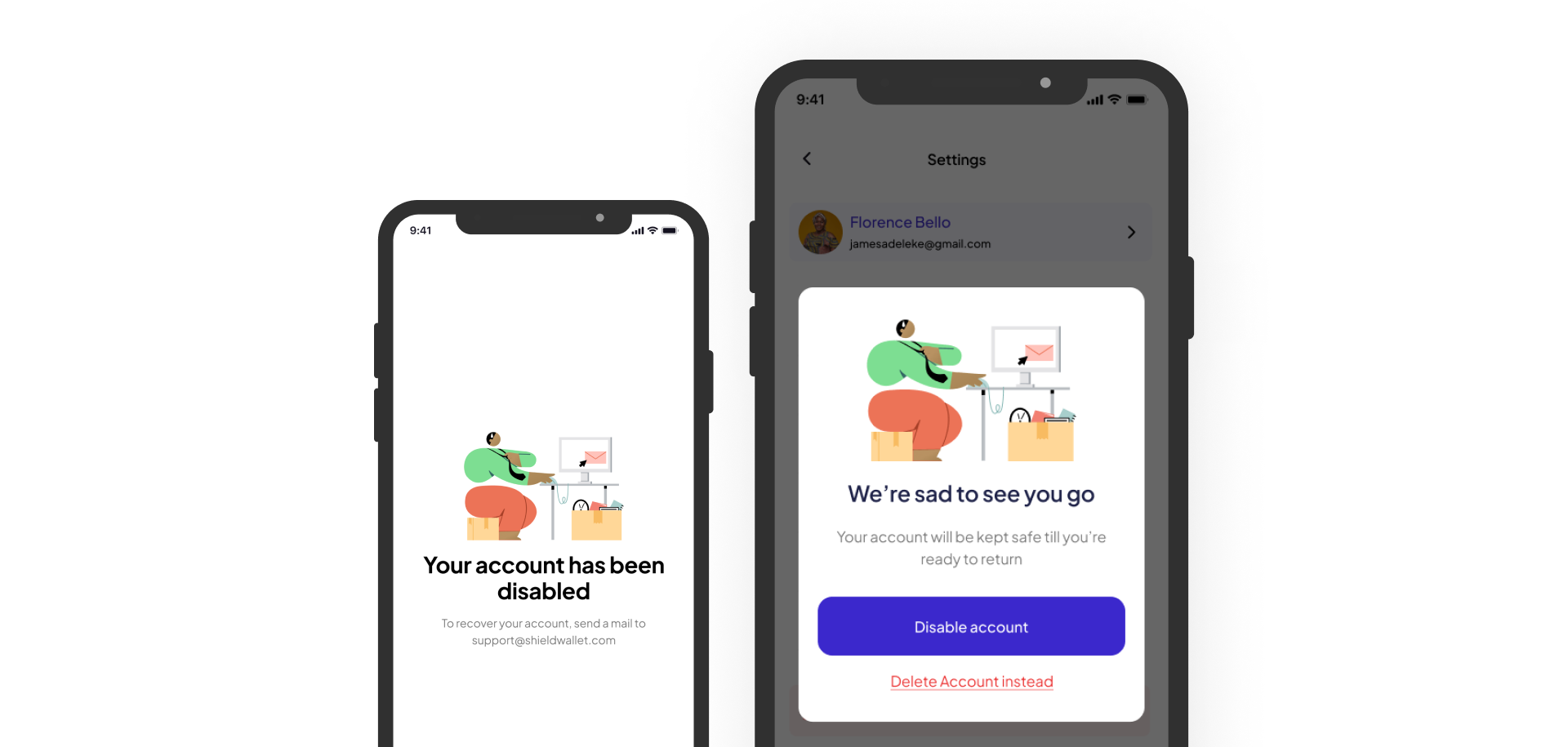

Facilitate easy reactivation of inactive profiles, ensuring that users can easily resume their wallet usage if it becomes inactive.

The user research included a survey and interviews to gather insights from potential users. The survey questions aimed to understand the target audience's age, occupation, digital wallet usage, desired features, motivations for saving, likelihood of using a savings-focused digital wallet, and concerns regarding financial services. The interview questions delved deeper into participants' financial habits, pain points with existing digital wallets, desired features, and overall needs.

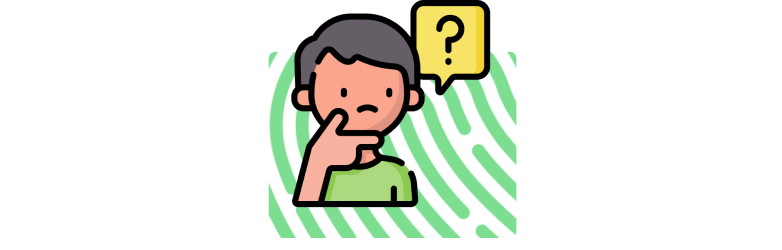

The double diamond framework was applied to structure the design process for Shield Wallet efficiently, given the time constraints. This approach involves two key phases: Discover and Define (divergent thinking to explore the problem space) followed by Develop and Deliver (convergent thinking to create solutions). In the initial stages, insights were gathered on user pain points and needs, which were then narrowed down to define the core challenges. This was followed by rapid prototyping, testing, and refining of the final product to ensure it met user requirements effectively within the short time frame.

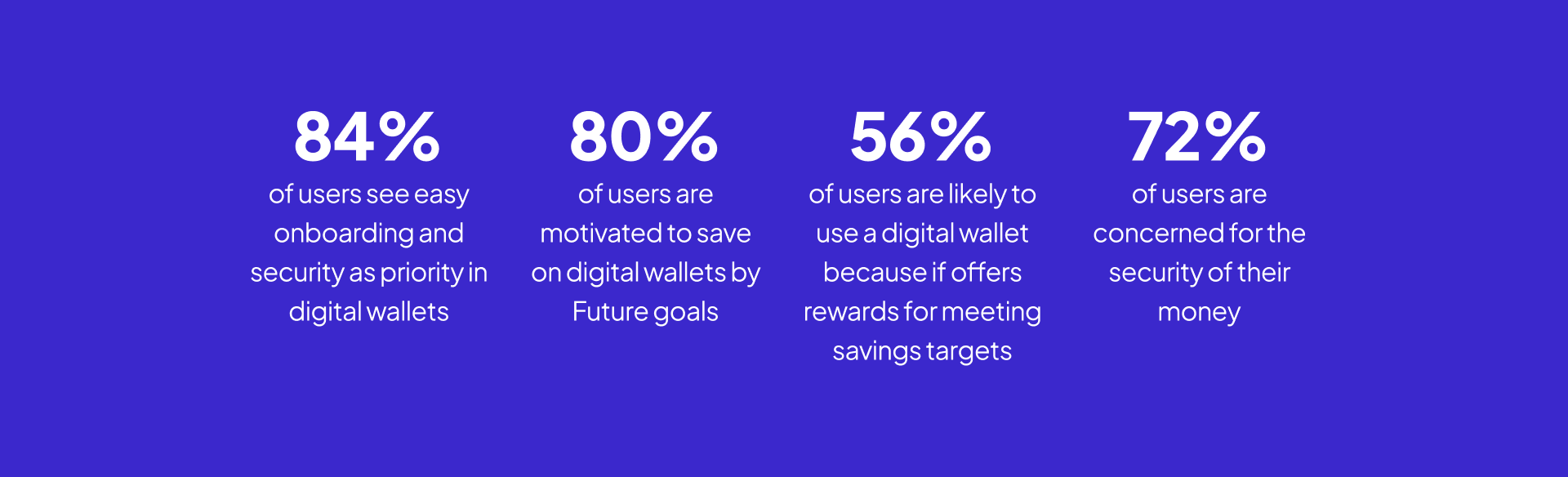

Two methods of user research were used; User Interviews and Surveys. The results revealed key insights about the motivations and concerns of digital wallet users. A significant 84% of users prioritize easy onboarding and security. Moreover, 80% of users are motivated to save for future goals, and 56% are likely to use a digital wallet that offers rewards for meeting savings targets. However, 72% of users expressed concern about the security of their funds. This feedback informed the design decisions, ensuring a balance between usability, security, and rewarding financial behaviors.

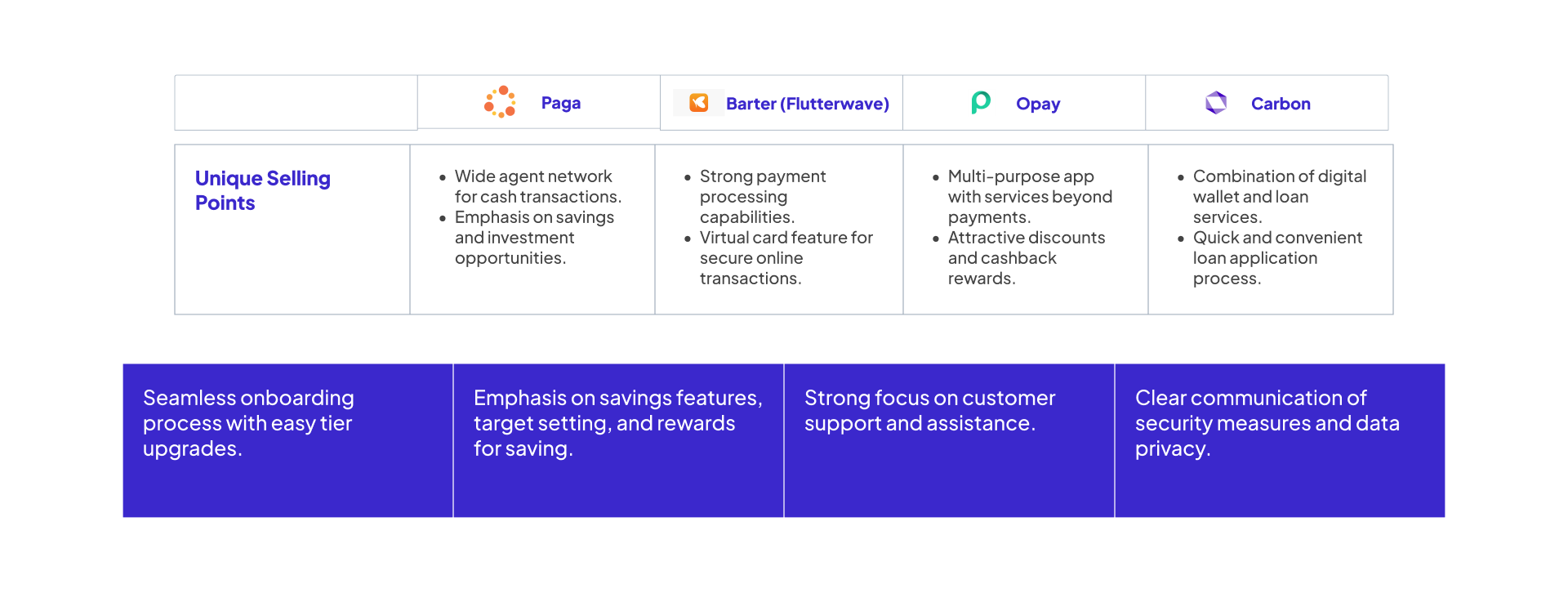

To effectively position Shield Wallet in the market, a competitive analysis was conducted, focusing on key players such as Paga, Barter (Flutterwave), Opay, and Carbon. These companies were selected due to their unique approaches to digital wallets and financial services, which cater to regions similar to Shield Wallet’s target audience. Each competitor provided valuable insights:

These insights guided Shield Wallet's strategy in feature prioritization and differentiation.

...A digital wallet for everyone from Odogwu's to Gen-A & Z, artisans, and market women.

Creating a wallet is as easy as signing up with your e-mail address or Phone Number and Verify

Easily move from tier to tier by providing necessary documents for verification

Easily move from tier to tier by providing necessary documents for verification

Tired of your wallet? you can disable your account, and reactivate it when you’re ready to save again.

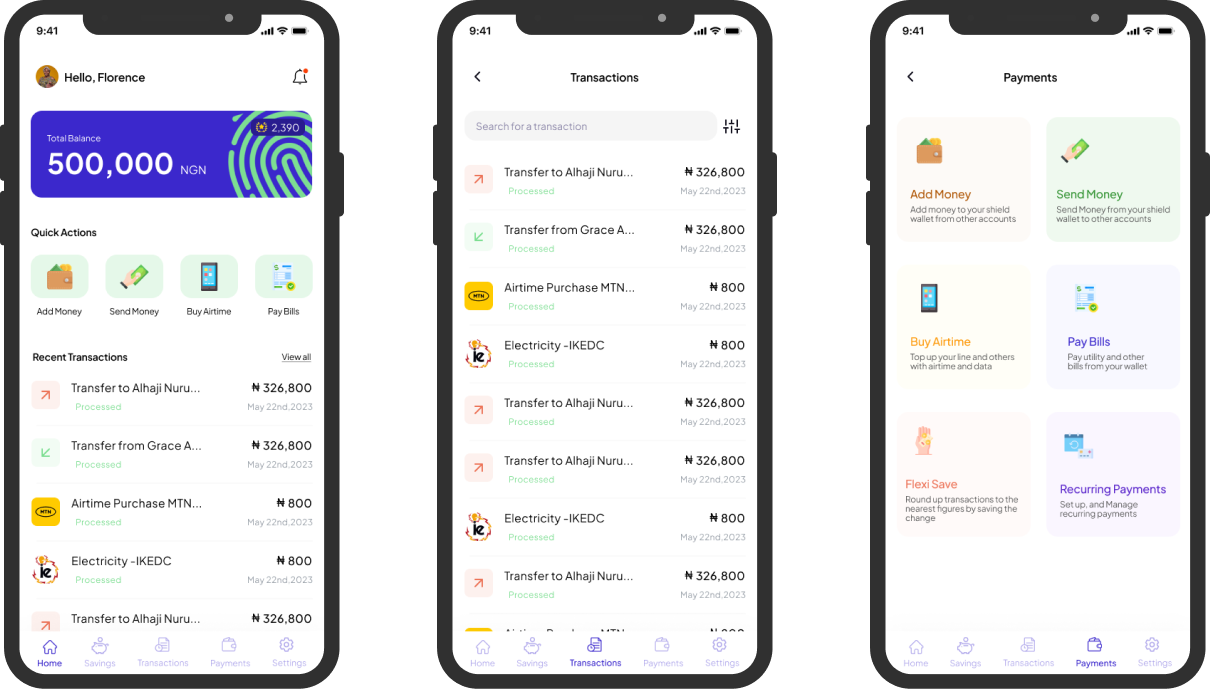

Buy airtime and pay bills

Save your change with Flexi Save

Save your airtime, and call/chat with customer service in-app

View transaction and saving history

Language preference options

Theme preference options for color accessibility

Font size option to make text legible

The Shield Wallet project was a deep dive into understanding user behaviors, motivations, and pain points within the growing digital wallet space. Through this project, it became clear that by addressing core user concerns, fostering trust through transparency, and offering features that motivate financial discipline, a digital wallet could move beyond being a transactional tool to becoming an essential part of users’ financial lives.